Do you want to improve your financial habits and reach your savings goals? If so, a savings challenge could be exactly what you need!

In this post, we’ll be introducing 8 effective savings challenges that you can try today. Whether you’re new to saving money or an experienced saver, these challenges are designed to help you reach your financial goals and create a brighter financial future.

This challenge is designed to help you build a habit of saving money gradually, over the course of a year. You start by saving just $1 in the first week. And increase the amount you save by $1 each week until you are saving $52 in the final week. This approach helps you adjust to saving money and get into the habit slowly, rather than feeling overwhelmed by having to save a large amount of money all at once. By the end of the challenge, you’ll have saved over $1,378!

This challenge is focused on getting you into the habit of saving quickly. You save a specific amount each day, such as $1, $2, or $5, for a period of 30 days. The idea is that by saving a little bit each day. You’ll build momentum and get into the habit of saving quickly. Plus, the short duration of the challenge means that you’ll see the results of your savings efforts in a relatively short amount of time.

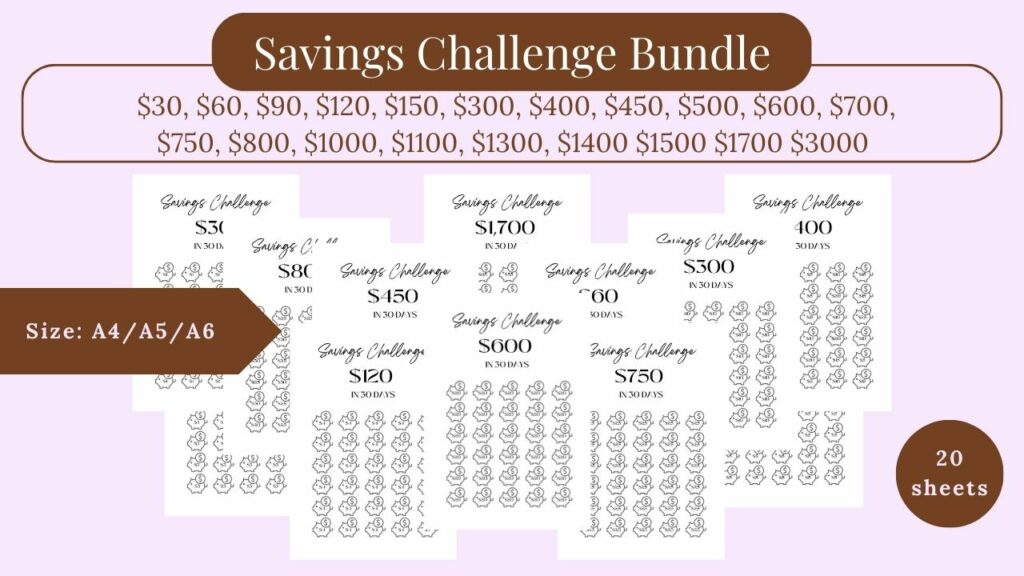

Are you tired of always struggling to save and falling short of your financial goals? Our Printable 30-Day Savings Challenge is here to help! This comprehensive bundle includes 20 unique challenges to help you track your daily, monthly, and weekly savings. With easy-to-follow instructions and a convenient printable format, you’ll be able to stay organized, visualize your progress, and stay motivated every step of the way.

With challenges ranging from $1 to $1700, you can choose the right one for your savings goals and adjust as you progress. And, with the three different PDF sizes included (A4, A5, and A6), you can easily find the perfect fit for your budgeting binder or cash envelope system.

Don’t let financial stress keep you from living life to the fullest. Start saving smarter with our Printable 30-Day Savings Challenge today and see just how much you can accomplish in just one month!

This challenge is the opposite of the 52-Week Savings Challenge. Instead of starting with $1 and gradually increasing the amount you save each week, you start by saving $52 in the first week and reduce the amount you save by $1 each week until you are saving just $1 in the final week. This approach can be helpful for those who need a quick influx of cash and prefer a more aggressive savings plan.

The No-Spend Challenge is focused on reducing or eliminating non-essential spending for a set period of time, such as a week or a month. During this challenge, you’ll have to be mindful of every purchase you make. And focus on reducing or eliminating expenses for things like eating out, buying coffee, or shopping for clothes. The objective of this challenge is to become more mindful of your spending habits and learn to live within your means.

The goal of this challenge is to build an emergency fund with $1,000 as quickly as possible. Having an emergency fund can provide peace of mind, helping you handle unexpected expenses without having to rely on credit cards or loans. This challenge is typically done by setting aside a portion of each paycheck until you reach your goal of $1,000.

The Debt Payoff Challenge is focused on paying off debt, such as credit card balances or personal loans. To participate, you’ll need to determine your debt amount, create a budget, and allocate extra funds towards paying off your debt each month. The objective of this challenge is to take control of your finances and reduce high-interest debt, helping you become debt-free faster.

This challenge is focused on building a savings cushion for unexpected expenses, such as car repairs or medical bills. The goal is to build up a fund that you can rely on in case of emergencies. It helps to reduce stress and providing financial stability. This challenge is typically done by setting aside a portion of each paycheck until you reach your goal for the rainy day fund.

The No-Coffee Challenge is focused on reducing small, daily expenses, such as coffee, snacks, or transportation costs. The goal is to reduce these expenses and save money each week by making small changes to your spending habits. By focusing on these small expenses, you’ll see quick, tangible results from your savings efforts and be motivated to keep going. You can set a specific amount to save each week. Or you can choose a different small expense to focus on each week, such as eating out or buying snacks. The objective of this challenge is to learn to live within your means and become more mindful of the money you spend each day.

These are just a few of the many savings challenges available. And each one has its own unique approach to help you save money and reach your financial goals. Whether you choose to participate in a single challenge or try several, the key is to make saving money a habit and stay motivated to reach your goal. Remember, every little bit helps. And by taking small steps each day, you’ll be well on your way to achieving financial stability and security.

Imagine the sense of pride and accomplishment you’ll feel when you save $10,000 in a year! While it may seem like a lofty goal, with a bit of determination and smart planning, you can make it happen. Here’s how:

The first step to saving money is knowing exactly where it’s going. Create a budget to track your income and expenses and identify areas where you can cut back.

Set up automatic transfers from your checking account to your savings account each month. This way, saving becomes a habit and you can watch your savings grow without even thinking about it.

Keep a tally of your savings progress each month. Seeing the numbers add up is a fantastic motivator!

Look for ways to earn extra cash, like freelancing or starting a side hustle. The more you earn, the more you can save!

Identify and cut back on expenses that are not essential, such as eating out or subscription services. Every little bit adds up!

Be mindful of your spending and look for ways to save money on everyday purchases, such as buying generic brands or shopping sales.

With these tips and a savings challenge under your belt, reaching your goal of saving $10,000 in a year is within reach. Imagine the peace of mind and financial stability you’ll enjoy with that much money in the bank! Go ahead, give it a shot!

In conclusion, a savings challenge is a great way to improve your financial habits and reach your savings goals. Whether you choose to save a set amount each month, save all your change, or participate in a no-spend challenge, these challenges can help you reach your financial goals and create a brighter financial future. So, what are you waiting for? Pick a savings challenge that works best for you and start your journey to financial freedom today!