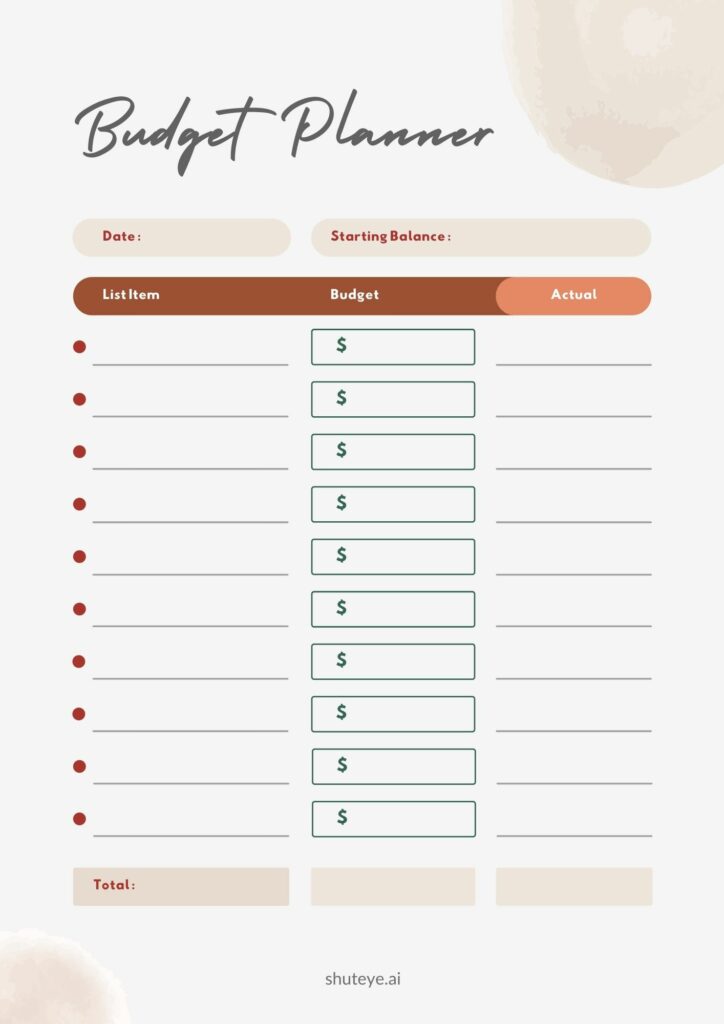

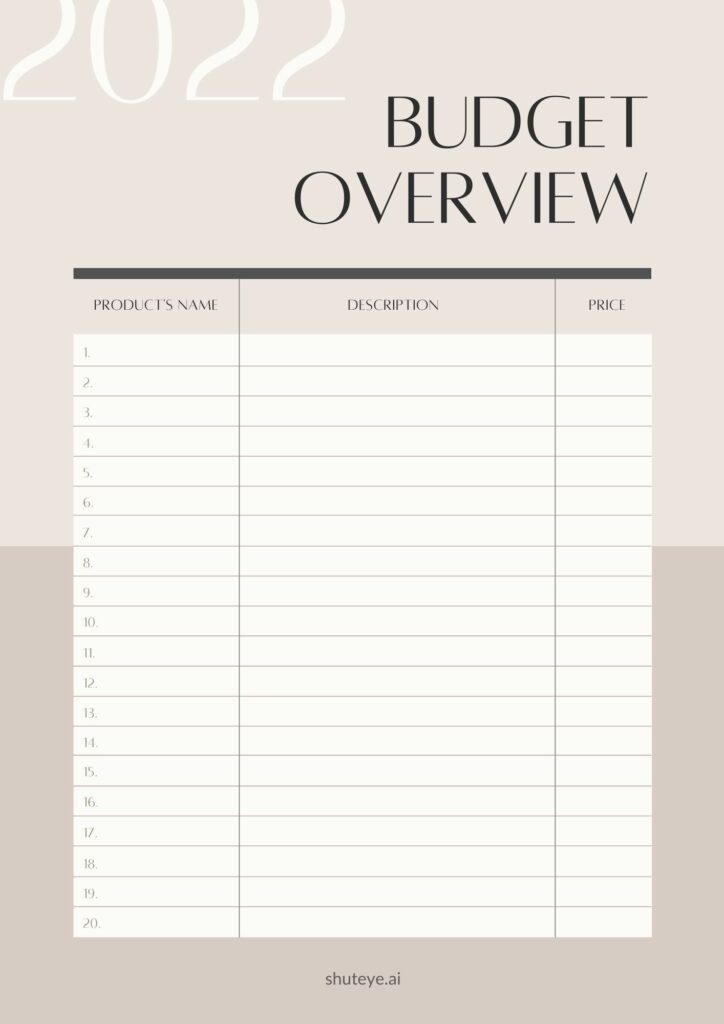

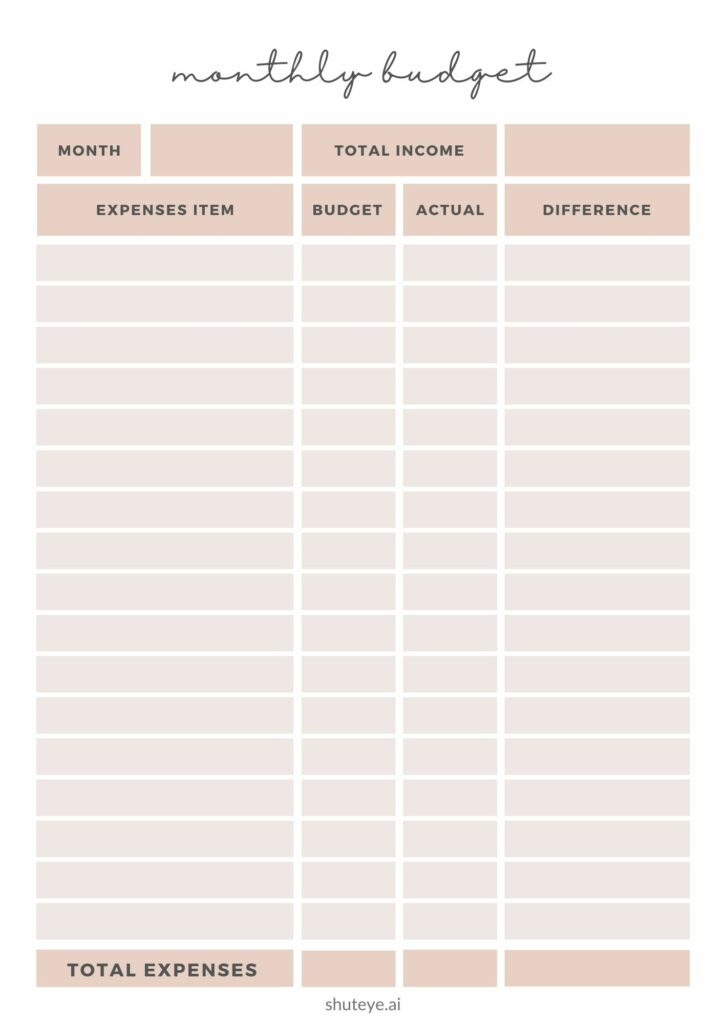

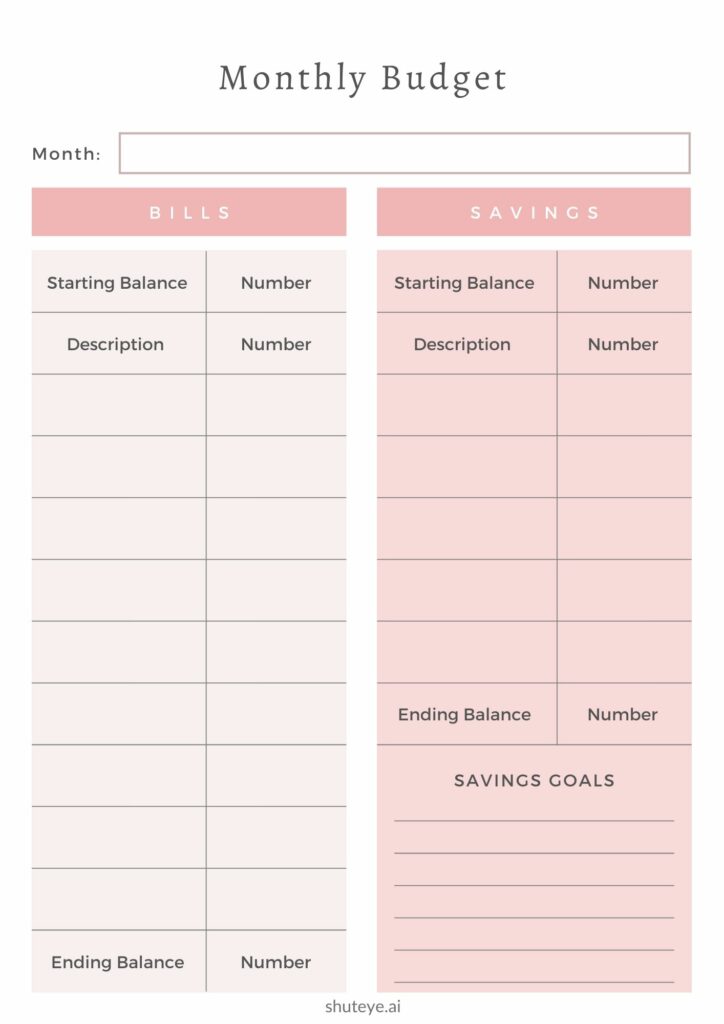

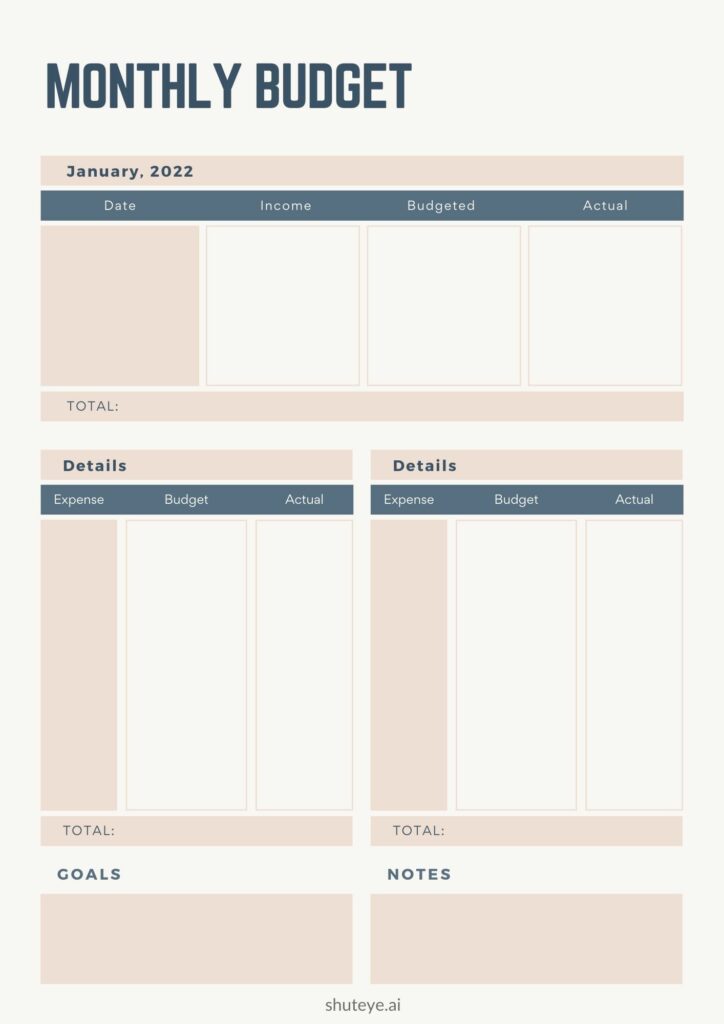

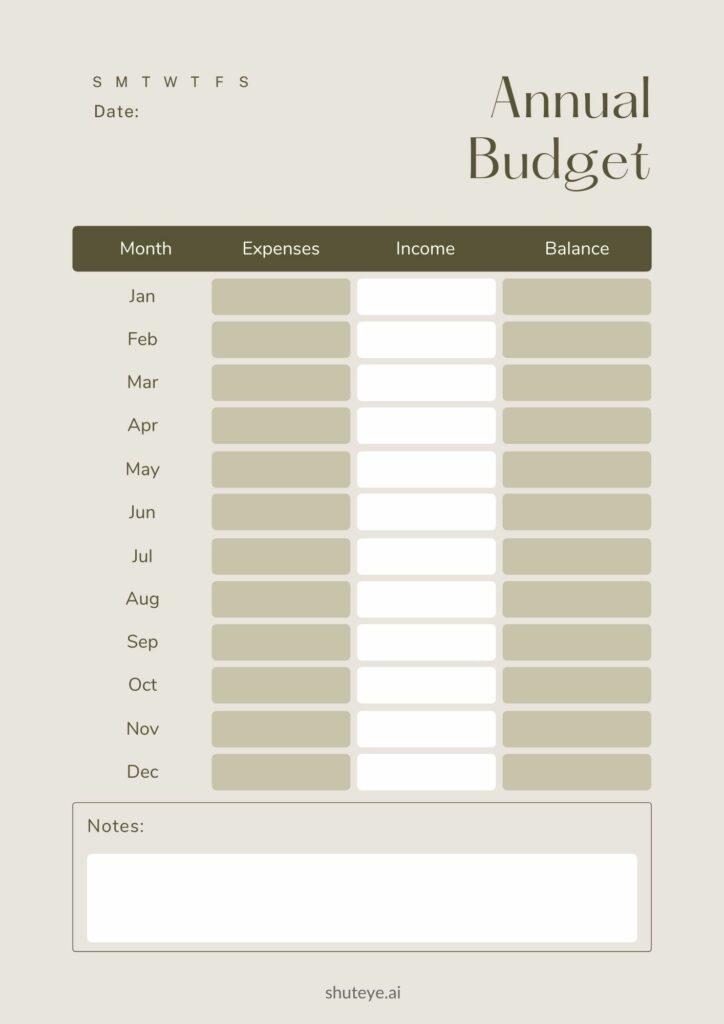

Want to keep track of how much money you make, save, and spend each month? You must have a budget! You’ll need a convenient way to track everything once you’ve made a budget, right? This is where free printable budget planner templates come in!

Before reading:

Are you looking for a budget planner that will help you stay on track with your finances? Look no further! Take your budgeting to the next level with my budget planner, now available in both pdf and excel! The excel version provides added flexibility and allows for even more detailed tracking of your finances. It contains 4 unique color schemes and 3 sizes(A4, A5, US Letter). Get your hands on a copy today!

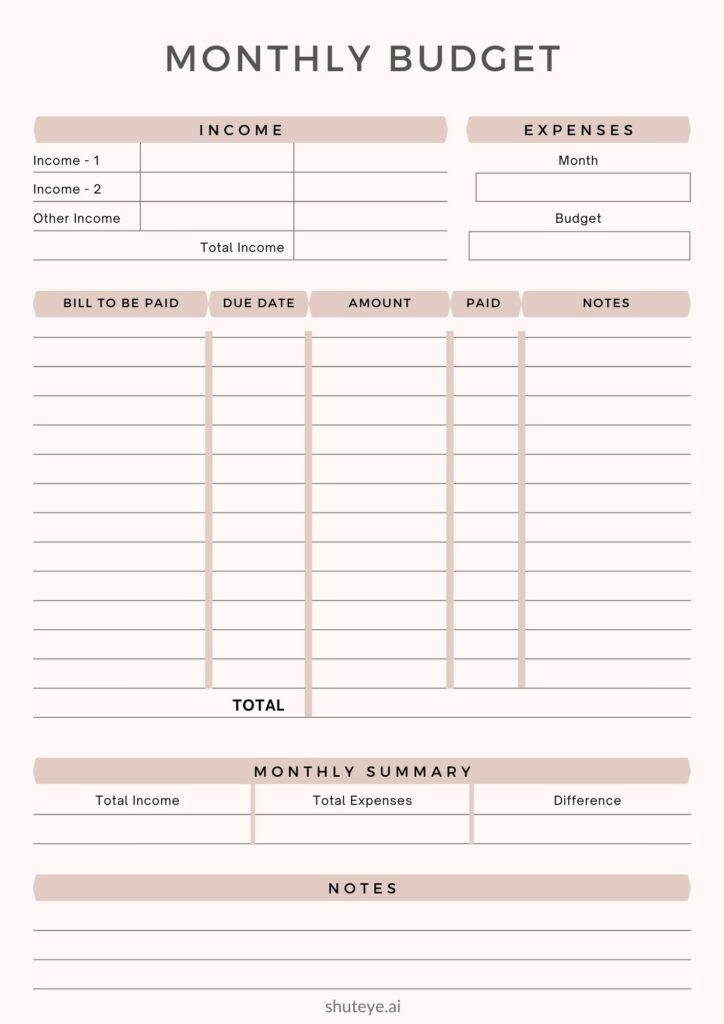

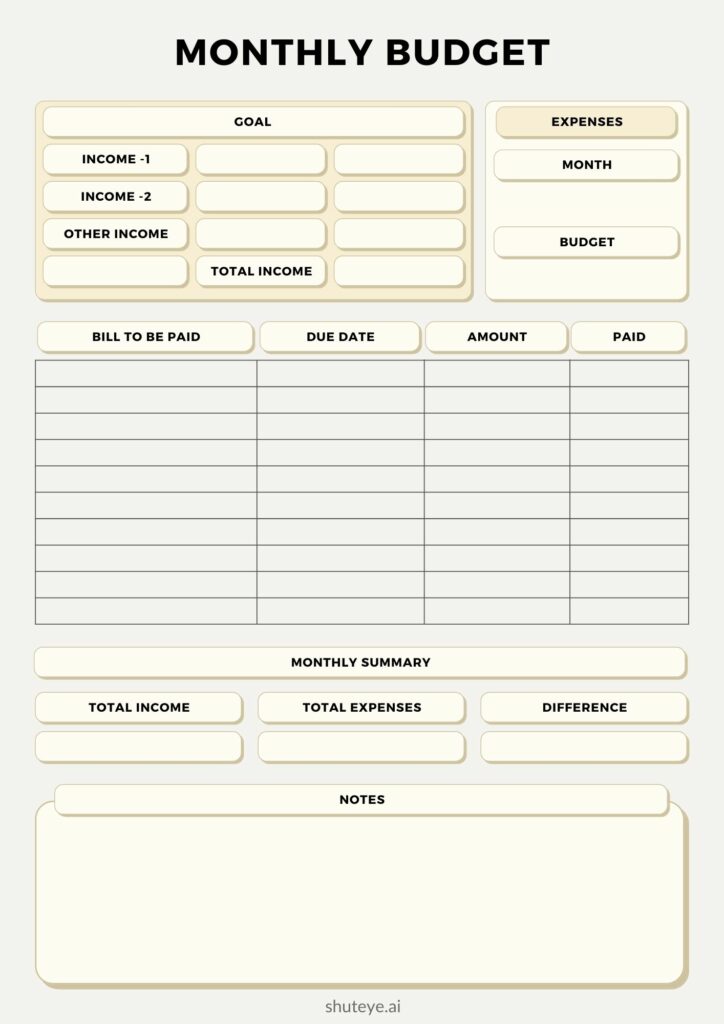

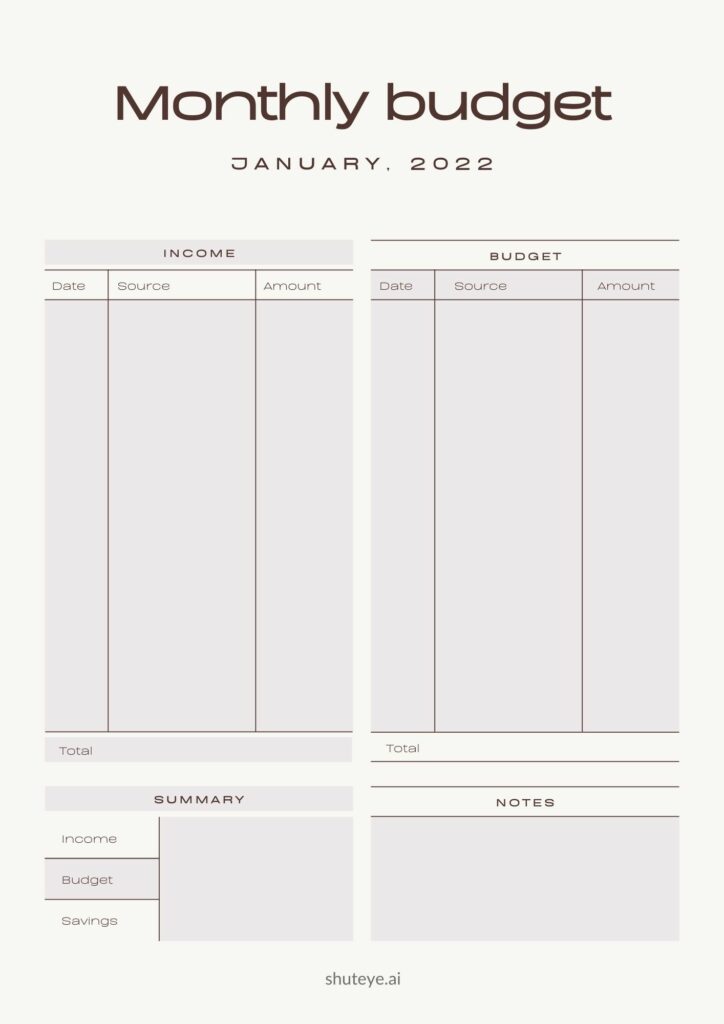

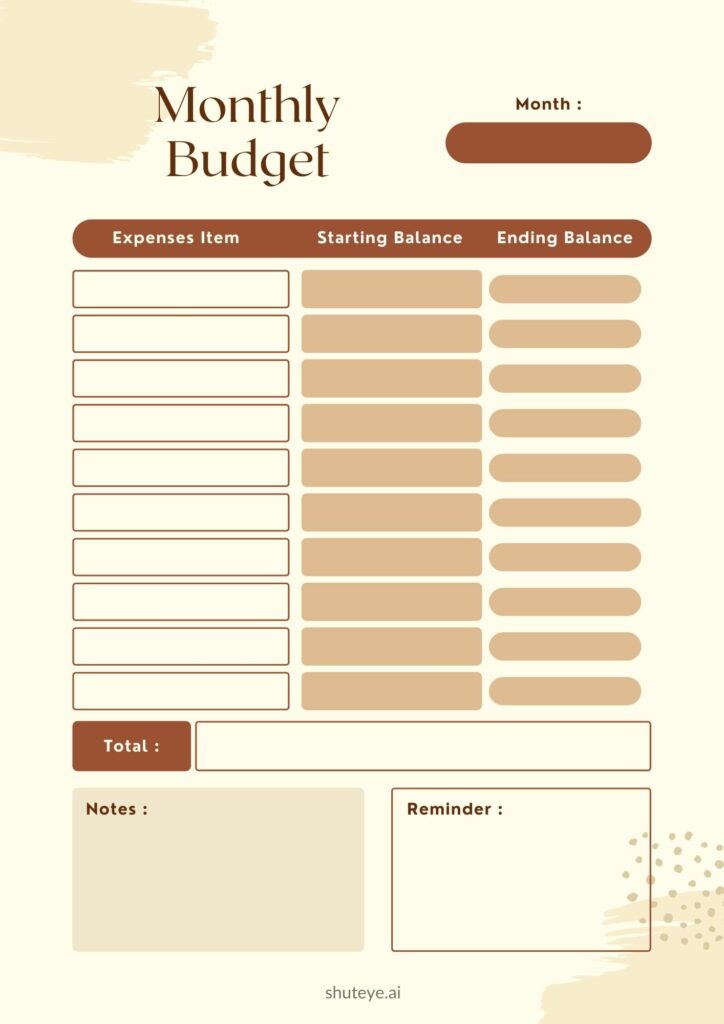

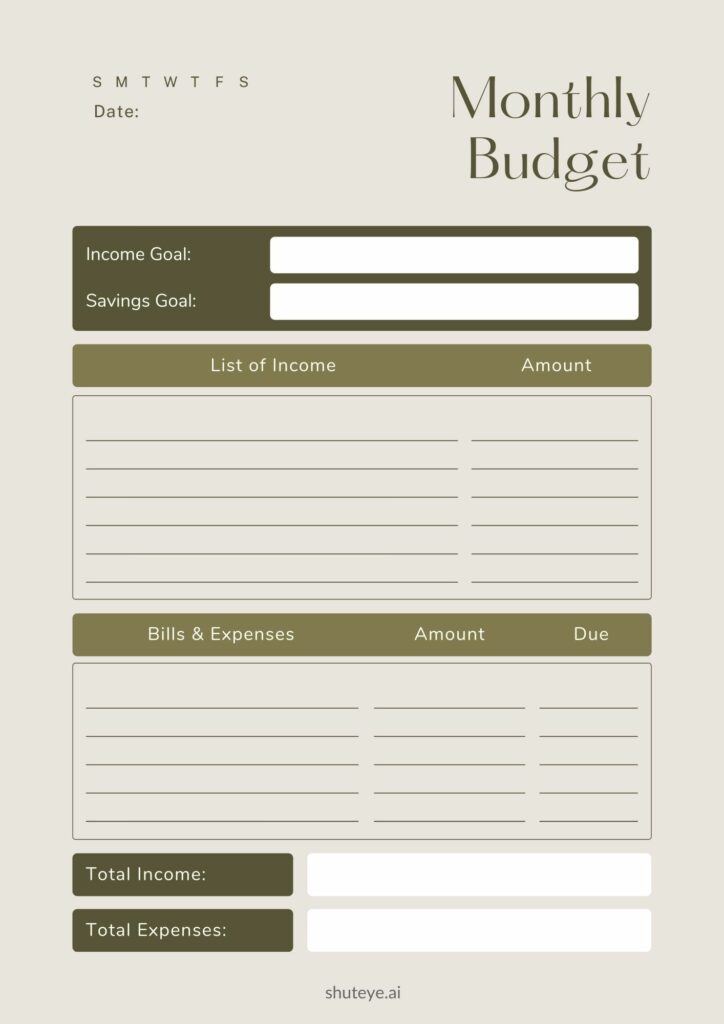

When it comes to budgeting, take-home pay is the only thing that matters. Forget about earnings before taxes. Your take-home pay is the amount of money you have available to spend or save in addition to what you may already be contributing to a retirement account at work.

Include other sources of income, such as social security, disability, pension, child support, regular interest or dividend earnings, and alimony, when computing income. Any money that you get on a regular basis can be considered revenue for your monthly budget.

Here’s how to determine what your monthly take-home income is:

If you are paid biweekly: Double your take-home pay for one paycheck by the number of paychecks in a year, which is 26. Then multiply this figure by 12 to get your monthly income.

If you are paid weekly: Multiply your weekly compensation by the number of weeks in a year: 52. Divide this figure by 12 to calculate your monthly income.

If Your Pay Varies: If your pay varies due to tips, varying hours, and/or commissions, you can still compute an expected monthly income by adding three months of income and dividing by three.

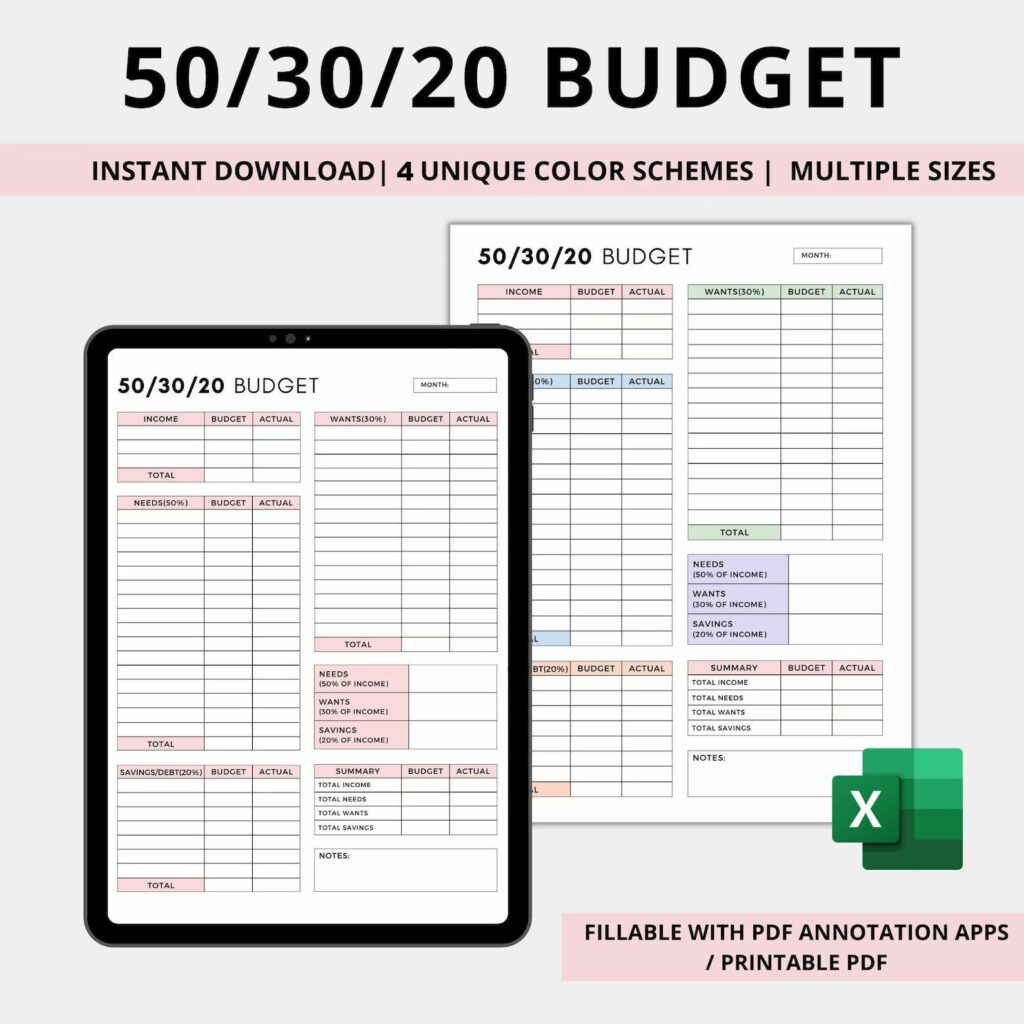

Budgeting does not have to be difficult, nor should it eat up hours of your time. In fact, the best strategies to budget are frequently the most basic. Take the 50/30/20 rule! The 50/30/20 rule is a simple monthly budgeting approach that advises you how much to put toward savings and living expenses each month.

The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply, and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants, and 20% for savings or paying off debt.

The 50/30/20 rule is a great way to solve that age-old riddle and build more structure into your spending habits. It can make it easier to reach your financial goals, whether you’re saving up for a rainy day or working to pay off debt.

By regularly keeping your expenses balanced across these main spending areas, you can put your money to work more efficiently. And with only three major categories to track, you can save yourself the time and stress of digging into the details every time you spend. Check out our time tracking tips to learn more.

Here’s what a budget that adheres to the 50/30/20 rule looks like:

Simply expressed, needs are unavoidable expenses—payments for all the necessities that would be difficult to survive without. Your most essential costs should be covered by 50% of your after-tax income.

30% of your after-tax income can be used to fund your wants. Wants are non-essential expenses—things you choose to spend your money on despite the fact that you could live without them if you had to.

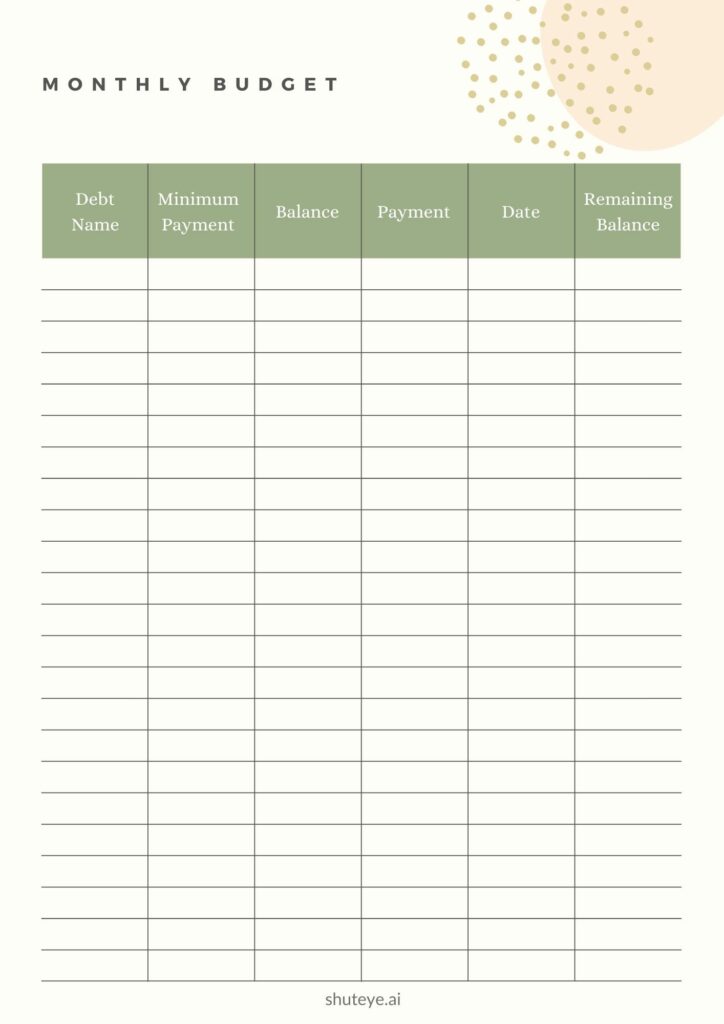

30% of your money should be used for savings or to pay off whatever debts that you may have. This should be a consistent budget that should not be touched for whatever reasons.

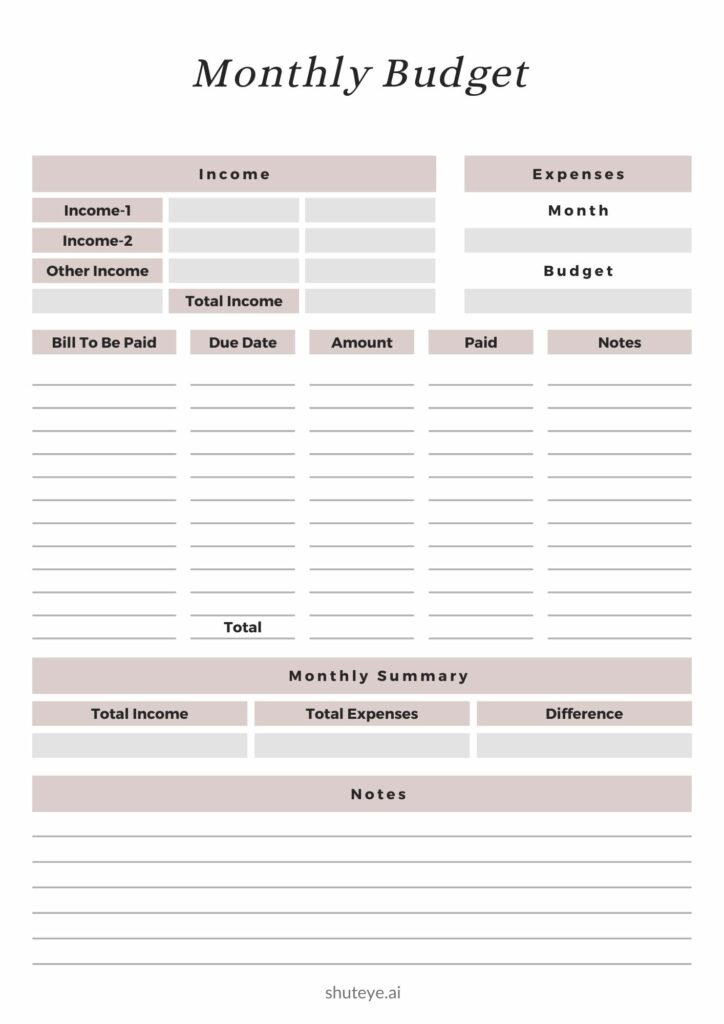

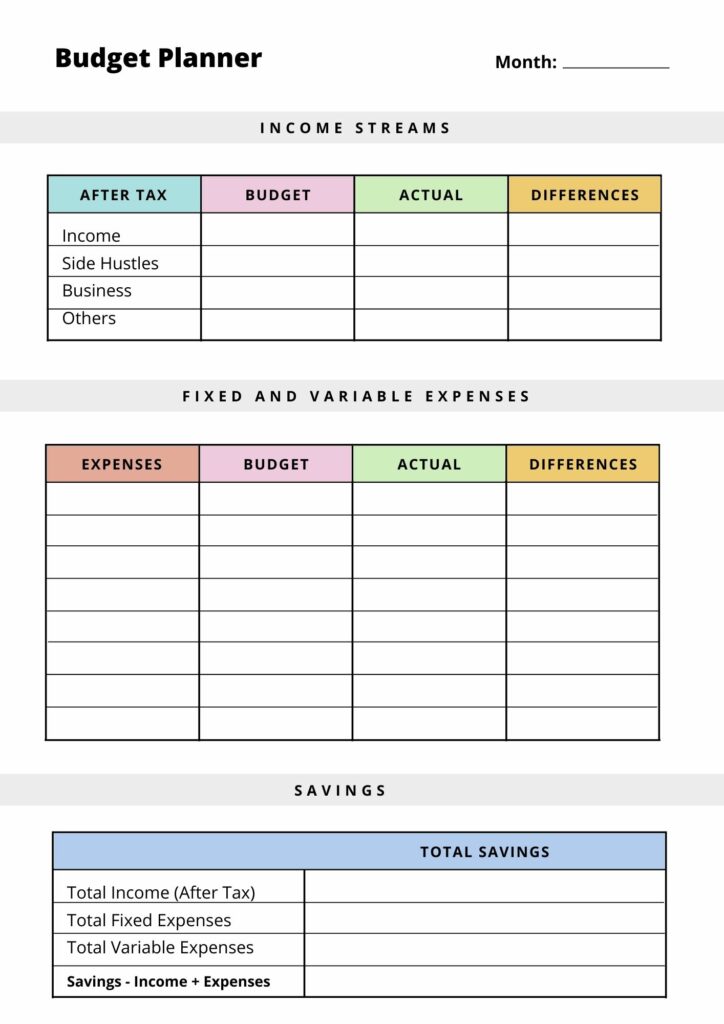

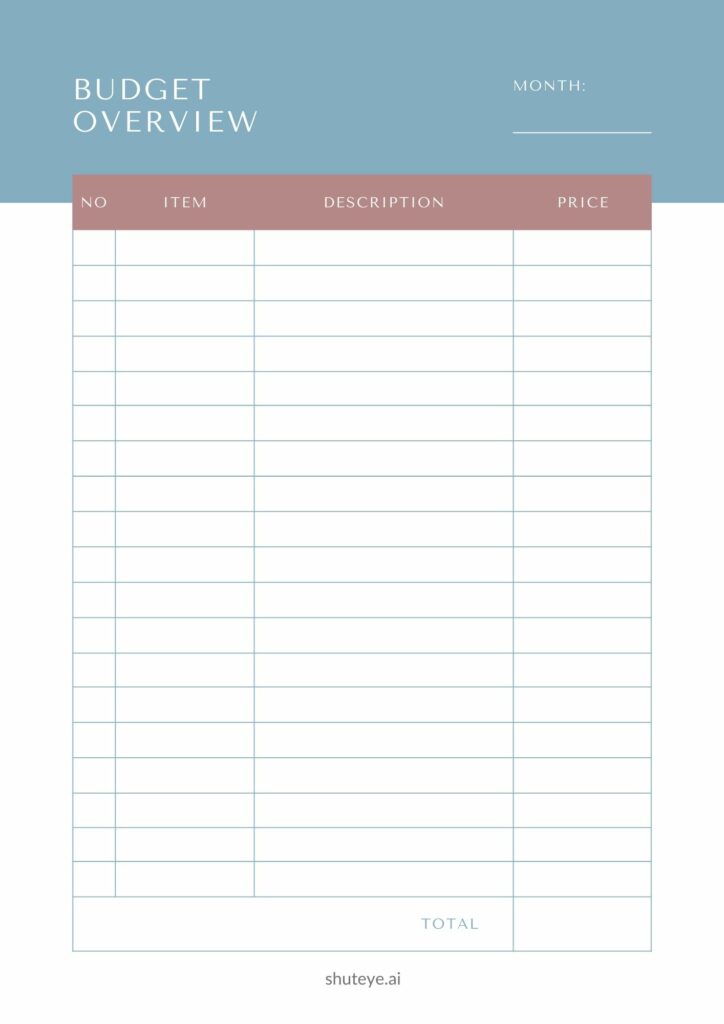

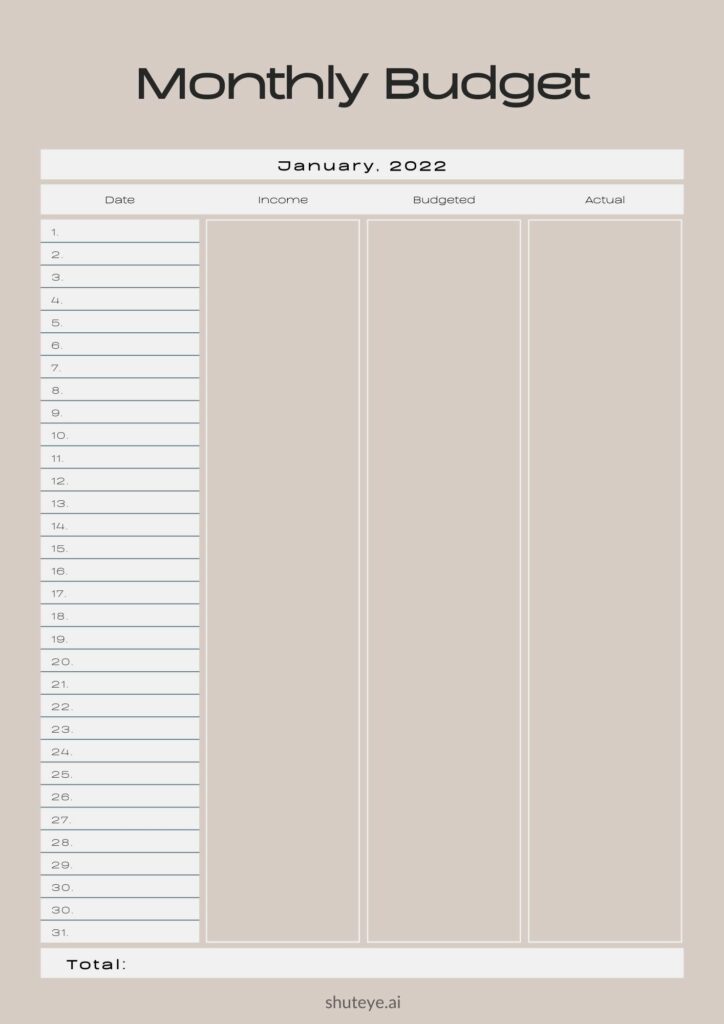

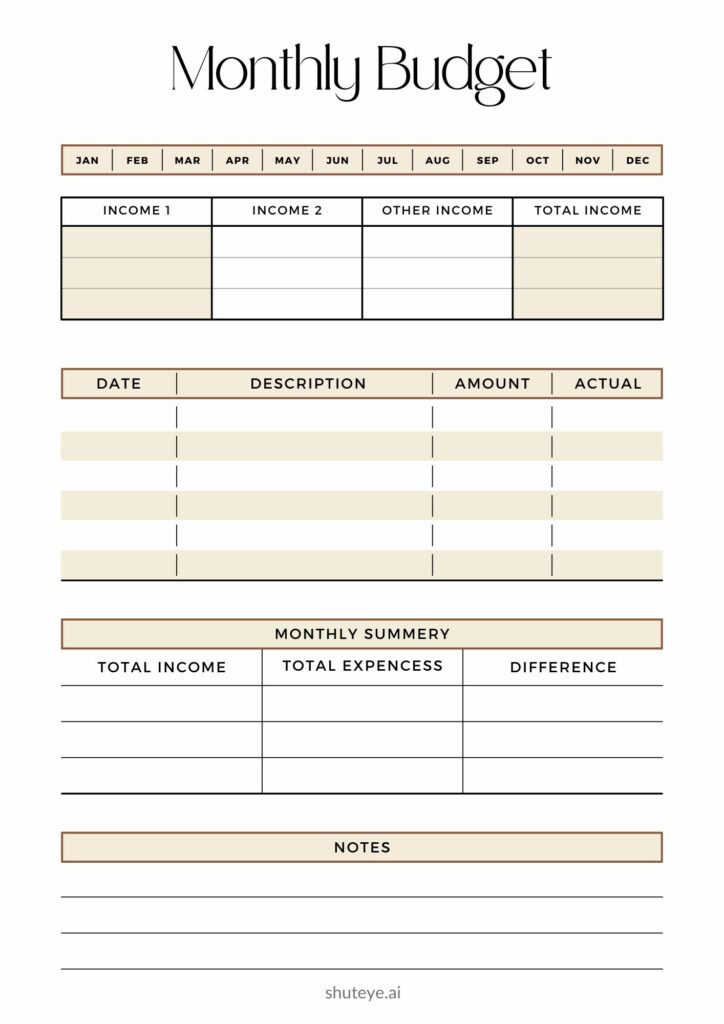

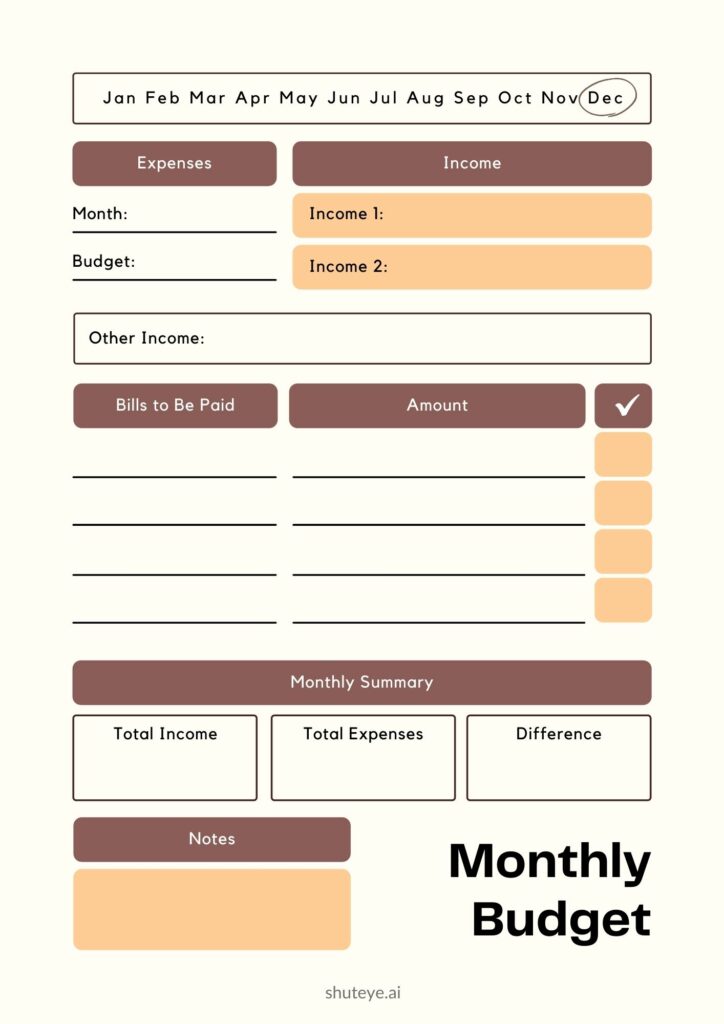

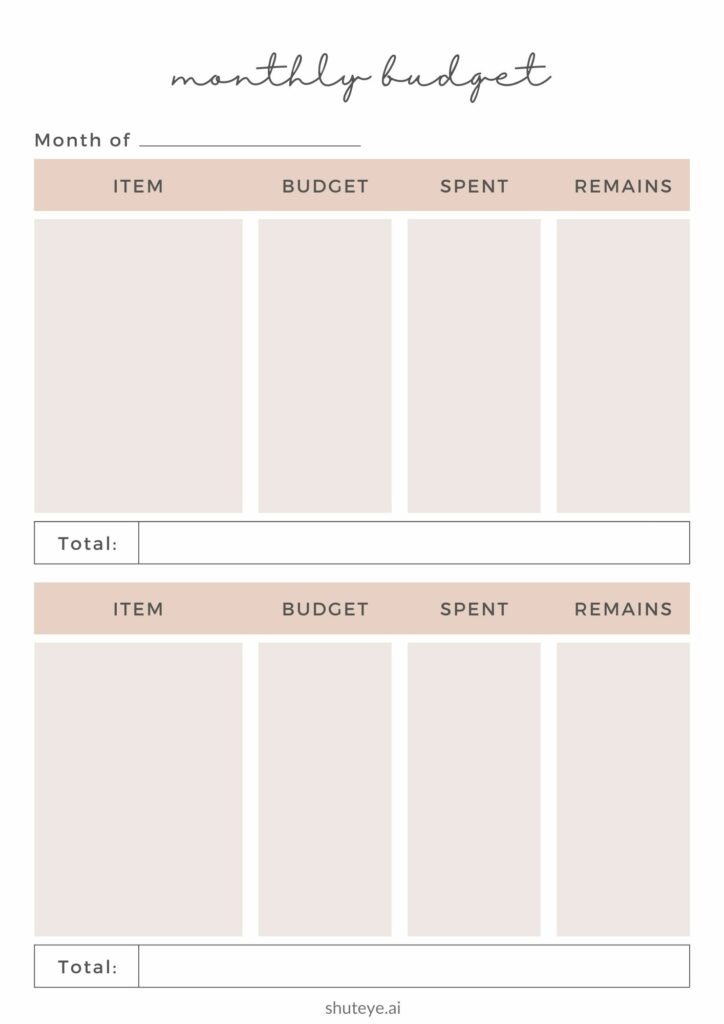

Follow the steps below as you set up your personalized budget with our free printable budget planner:

Write down what matters to you and then put your values in order.

Write down your goals. Think about what you want to accomplish financially in the next three months, the next year, and the next three years. Use our ideas for the end of year reflection.

Figure your available income (the amount of your take-home, or net, pay). Do not include overtime pay, because you shouldn’t rely on that as regular income.

Review your checkbook register, credit card statements, store receipts, and more. Where is your money really going? “Fixed expenses,” such as a rent, auto, or student loan payments, are easy to determine. “Flexible expenses,” such as food, clothing, and entertainment, vary from month to month. Don’t forget about expenses, such as taxes or insurance, that are billed quarterly, semi-annually, or yearly.

Think of your budget as a “spending plan,” a way to be aware of how much money you have, where it needs to go, and how much, if any, is left over. Your budget should meet your “needs” first, then the “wants” that you can afford. Your expenses should be less than or equal to your total income. If your income is not enough to cover your expenses, adjust your budget (and your spending!) by deciding which expenses can be reduced.

Be sure to review your budget regularly. Does the plan still meet your needs and help you achieve your goals? If not, make some adjustments or create a new budget that better meets your needs.

Free printable budget planners can be the first step to finally getting your finances straight, If you’re trying to get yourself out of debt then you need to spend time creating a realistic budget and a budget planner is the perfect tool.